Travel Insurance: Why You Need It

Travel Insurance: the million-dollar question, and ultimately, it’s determined by your verdict.

When it comes down to dissecting travel insurance, there’s copious confusion. And it can honestly be one of the most fastidious factors in devising your next adventure. It’s often overlooked, but it should be one of the essentials when you’re planning on gallivanting around the globe.

Whether it’s a fun-packed week baking your buns along the Mediterranean in Mallorca or a few months of action-packed adventure in Andorra, Travel Insurance is something you shouldn’t go without.

I know, it’s easy to say ‘f**k it’ and free-ball it. But hey, just remember, shit happens. Despite your meticulous efforts and preventative planning, remember that you can’t control everything.

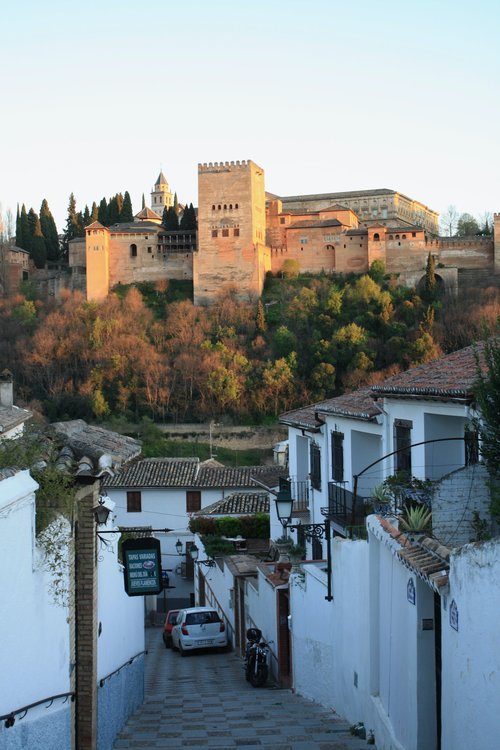

I was one of those travellers who didn’t vouch for it. I jumped out of a plane in New Zealand, hiked an active volcano in Bali, and went cliff jumping in Malta, all without worrying about splurging a dime on insurance… But when I moved to Barcelona, I was legally required to have travel insurance for my visa agreement. So there was no room to budge.

I had to fork out a hefty, triple-figure amount of cashola just for travel insurance alone. But, thankfully, nine months later, when my apartment got broken into and my valuables got stolen, I couldn’t have been more grateful to have set that cash aside. That event smacked me in the face. Not literally. But it was like I was jolted awake, out of ‘I’m invincible’ mode, and into reality.

From time to time, these things do come up. And not having travel insurance could cost you tens (or hundreds) of thousands of dollars.

Based on my own experience and after listening to numerous narratives of other seasoned travellers’ unfortunate fiascos, my honest advice is to get it.

Here’s what we cover in this travel insurance guide:

What is Travel Insurance?

Factors Affecting the Cost of Travel Insurance

What Does Travel Insurance Cover?

What You Should Look For in a Plan

Best Travel Insurance Companies

FAQs

What is Travel Insurance?

Travel Insurance comprises coverage for particular financial losses that can occur while abroad. From lost luggage to medical emergencies, it can also provide access to assistance services. For first-time travellers, no doubt the subject alone can stir up some confusion.

Here’s a handful of the different types of insurance available:

Travel Health Insurance includes basic coverage for accidents, injuries, and hospital visits while you’re abroad.

Medical Evacuation Insurance covers you for transport if you need to get to a major hospital for treatment.

Trip Cancelation Insurance includes basic coverage for unexpected interruptions to your plans.

Baggage/Property Insurance includes coverage for theft or damage to your belongings while you’re overseas.

The policyholder must pay a premium (small fee) for the above-listed types of insurance options. Particular factors, such as age and pre-existing conditions, will determine the final fee.

Your choice of travel insurance generally depends on several factors, like how often you intend to travel within the year, the destinations where you’re headed, and who will be with you on those trips.

Factors Affecting the Cost of Travel Insurance

A decent travel insurance plan typically costs around 4% to 8% of a trip’s total price tag. The price varies according to the following:

Length and cost of the trip: The longer/more expensive the trip, the higher the policy cost.

Cost of local health care: Higher health care costs in your destination can increase the insurance price.

Medical conditions you want to be covered: Conditions you already have will increase the cost of travel insurance coverage.

Amount and extent of coverage: The more risk a policy covers, the more it will cost.

Your age: The older you are, the higher the insurance price.

There’s also the option of either an individual or group policy or one for a simple, single-trip, or an annual multi-trip policy. If you travel more than twice a year, an annual, multi-trip policy is the more cost-effective.

Standard Travel Insurance Covers:

Sickness or Injury

Any costs incurred due to illness or injury, i.e. medical expenses, charges to your place of residence or selected quarantine base, etc.

Top tip: Check the maximum coverage for medical expenses. Remember that a hospital stay or simple surgery can be costly in some countries (e.g. Iceland, Finland, Australia, etc.)

Travel Delays or Interruptions

Delays or interruptions to your travel plans that temporary restrictions or world health guidelines may cause.

Lost, Stolen, or Delayed Baggage

Helps you when dealing with lost, stolen, or delayed baggage.

Cancellation and Interruption

You can be reimbursed for the vacations not taken. Additionally, you can be reimbursed for an early return caused by health reasons or the death of a relative.

Top tip: Suss out the amount covered for curtailment and cancellation. This will establish whether or not you can claim reimbursement for excursions or transport costs you’ve already paid for.

What to Look for in a Travel Insurance Plan

Given the modern-day world’s marketing efforts, there’s no doubt you’ve been swamped with many mind-numbing businesses, policies, and fancy-ass terminology that left you feeling nothing short of overwhelming. When you think you’ve made your decision, you pick up something in the fine print and then have to start your search again.

So what are some of the basic things you should look for in a travel insurance plan?

A high coverage limit on your medical expenses.

Emergency evacuation and care (separate from your medical coverage).

Coverage for most countries throughout the world.

Offer a 24/7hr assistance line.

Coverage for lost, damaged, or stolen objects such as jewellery, baggage, documents, electronics, etc.

Covers cancellations for hotel bookings, flights, and other transportation bookings if you have a sudden illness, death in the family, etc.

Including political unrest, natural disasters, or other emergency situations.

Things to keep an eye out for:

When you travel, ensure you have a copy of your insurance policy’s details. Highlight your policy number and the emergency assistance numbers.

Before choosing your insurance policy, clarify that the regions covered include access to whatever travel assistance you may require.

Ensure you let your insurance provider know if you have any pre-existing medical conditions. If not, your claim may be rejected.

What are the Best Travel Insurance Companies?

Best Overall Travel Insurance: World Nomads

Medical Evacuation: Medjet

Student travellers: Travel Insurance Direct

Older travellers: Insure My Trip

Expats: IMGlobal

FAQS

Why is it important to have travel insurance?

Travel insurance can protect you from unforeseen circumstances that may occur abroad. If anything goes wrong, you’ll have peace of mind knowing you’re covered from financial loss.

What is covered by travel insurance?

A standard travel insurance plan covers medical costs, ambulance fees, lost baggage and stolen goods. A comprehensive plan can cover trip cancellation or interruption, rental car protection, etc.

Do I need insurance to travel to Spain?

Travel insurance is mandatory if you need a Schengen Visa to enter Spain. Travel insurance is still highly recommended if you don’t need a visa.

Travel Insurance should be one of the essentials if you’re heading overseas. Unforeseen circumstances can pop up everywhere; I mean, who could’ve seen Covid-19 coming…

Rome is known for its historical monuments, colourful culture and delectable cuisine. There’s plenty to pack into your itinerary, but if you tire of Italy’s capital, escape on one of these day trips from Rome.