9 Creative Ways to Save Enough Money to Travel

Let’s be honest. Saving money is difficult. Saving money to travel can be even more difficult. With a never-ending, incoming wave of bills, groceries, and demands that, in one way or another, eat away at our money, sometimes, setting aside sufficient funds to travel doesn’t always persist as a priority.

Money management isn’t exactly sexy, per se. But it just so happens that there are a handful of creative ways to inspire yourself or trick yourself into putting away enough money to set off on your next adventure.

First things first. There are two basic rules you need to set for yourself to make this work. With just a splash of creativity and a sprinkle of sacrifice, funding your next adventure is more than feasible.

Here’s what we cover in this guide:

9 Creative Ways to Save Money to Travel

16 Different Ways to Save More Money

FAQs

Be Strict With Your Travel Budget

Construct a travel savings budget that you will stick to! Don’t go ham. Aim for a balance instead of excess or deficient funds for your day-to-day expenses.

Consider Alternatives for Your Next Adventure

This means travelling on a budget instead of splurging hundreds of dollars on unnecessary expenses.

For the vast majority, travelling on a budget can seem like a very overwhelming situation to put yourself in, and unfortunately, that alone can deter a large sum of people from stepping out there. But you certainly don’t have to let money be an inhibitor to travel the world!

I put together a comprehensive post with genius, tried & tested travel hacks that can assist you in finding cheap flights, hotels, and experiences that can make your daydreams of adventure a reality, and soon. Check out all of my best Budget Travel Hacks.

I’ve compiled a list of 9 ways you can stop yourself from splurging and salvage your source of income instead. Let’s get down to it!

Say Ciao to Your Caffeine Addiction

I’m going in balls deep with this first one. If you want to travel, it’s time to say adiós to your daily cuppa joe from your local café.

As much as we feel that we require a coffee to kickstart our day and spur us into action, the reality is that it’s not a necessity but a luxury.

Coffee is the most commonly consumed psychoactive drug globally and for damn good reason. There’s nothing like that feeling of when the caffeine hits your bloodstream, then further travelling to your brain and releases all types of chemicals… and the next minute, you’ve dramatically converted from sloth-mode into a toddler who’s just demolished two blocks of chocolate. Awooga.

Let’s get down to some good, old-school mathematics. Spending $3 daily on a coffee equates to $21 a week or $84 a month that you could put in your piggy bank… If you simply can’t ditch your daily dose of caffeine, opt for an at-home brew machine or an alternative that you can buy in bulk and whip up for yourself at home.

Give up Your Gym Membership

Don’t get me wrong; I love the gym. But if you’re not a gym junkie who’s smashing it out daily, you’ve got to ask yourself, is it worth your money? Can you invest in a set-up at home?

Consider purchasing a set of dumbbells, a yoga mat, etc. You don’t need much for an at-home workout! Plus, you’ll be surprised at how much cashola you can save. Think about it.

Instead of splurging $30-100 per month, you’ll be putting that cash directly into your savings, and within just three months, you could save anywhere between $90-300…

You could also think about alternatives to the traditional gym workout, i.e. taking the dog for a longer walk/run, bike riding to/from work instead of driving or joining a sports team with a few friends… the possibilities are endless. Does anyone out there fancy joining my dodgeball team?

Substitute Staying in for Socialising Out on the Town

Just because you’re ditching the sweaty nightclubs and staying home doesn’t necessarily mean that your social life has to take a plunge with it.

Invite your mates around to your place, invest in a disco ball, pump up the volume on your speakers, and get jiggy with it.

You don’t have to drop the big bucks to have fun.

Think about hosting movie marathons, alcohol-infused arts and crafts, game nights, etc. That way, you can socialise and save money at the same time.

If you spend an average of $20-100 a week on going out, you could save your piggy bank between $80-400 a month just by trading going out for staying in.

Create yourself a solid hibernation station…

Spruce up Your Home, DIY Style

Decorating your new apartment does not come cheap, but being frugal doesn’t ineludibly mean you’ve got to miss out on stylish pieces.

Put your hand-me-down hat on and rummage through the myriad of second-hand stores. Think garage sales, Gumtree/Craigslist, thrift stores, etc. You can recover or refurbish anything if you put your mind to it.

My aunty was the queen of this. She used to purchase all types of second-hand goods, and by the time she was done sprinkling her magic on it, you’d think whatever she had her hands on was brought from the store, brand-new.

You could buy material of your choice, then cover old pillows, sew oversized clothing, and create curtains… Your place can go from bore to galore in seconds. Sure, there’s no doubt you’ll inevitably have to scavenge your way through junk, but you know the saying: nothing comes easy!

Purchasing previously-owned goods has many perks, not just for your battling bank account, but more importantly, for the environment. Don’t get me wrong, the musty scent of some thrift stores can be a little less of an alluring aroma and a lot more towards the nauseating end of the scale, but there is absolutely nothing like that enticing smell of a bargain that’s calling out your name or the pure thrill of getting your grubby little hands on a hidden treasure. Check out this post on Why You Should Buy Second-Hand.

Get Your Baker’s Hat On

From my experience, this is one of the biggest game-changers when it comes down to saving your dosh.

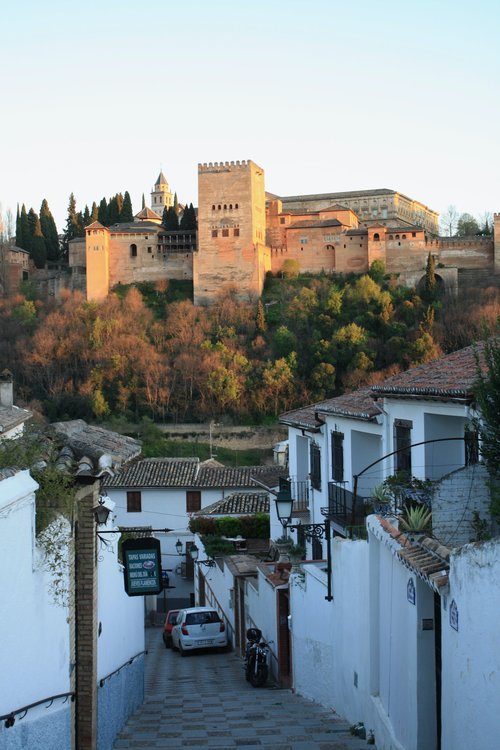

Before I moved to Spain, I was dedicated and devoted to a strict take-away diet consisting of KFC chicken nuggets and delectable fast-food burgers.

Once I moved abroad, I was forced to cook my meals due to the lack of funds… I finally began to comprehend just how significant of a difference cooking at home is compared to eating out.

You don’t have to be an absolute wiz in the kitchen to be able to cook. You can start with simple recipes and eventually work up to the more complicated meals.

Don’t be afraid to ask your roommate or a friend to show you some basic techniques, that way; you can reduce your cooking time and not spend two hours chopping those goddamn carrots.

If you spend an average of $50-100 per week on eating out, in just one month, you could save anywhere between $200-400…

Love Thy Budget

Remember, people; your budget is your friend. It is not your enemy. To successfully save your money, you need to embrace budgeting fully.

Hug your budget. Eat with your budget. Shower with your budget. Love thy budget… But in all seriousness, don’t just chuck a couple of your expenses into that Excel spreadsheet. Keep track of everything and anything you spend each month. Then, at the end of the month, review your expenditure and tally up the areas in which you could cut back.

Subsequently, set aside specific amounts for the upcoming month. For example, I generally put aside (per month) €100 for groceries, €30 for transport, €450 for rent, etc. Once you’ve separated your cashola and concocted some sort of a plan, do your darn well best to stick to it! Hold yourself accountable for your spending, and think twice before splurging.

Challenge Yourself With a Second Job

Cue the song, ‘’She Works Hard for the Money’’ by Donna Summer…

This one goes without saying. It’s a no-brainer. Most people feel reluctant or less inclined to take on a second job because they’re under the illusion that it’ll require too much commitment and eat away at their free time.

But, the ghastly reality is that this is the best way you can save up enough cash to travel. Before I made a move to Barcelona, I was working three jobs. When I arrived in Barcelona, I was working four jobs. Your social life will take a toll, but your piggy bank will reward you for your efforts.

If your schedule is somewhat flexible, consider a second job!

Even if you can’t commit to another part-time position, you could easily pick up the odd job here and there. Think about babysitting, mowing your neighbour’s lawns, walking dogs, cleaning houses, doing handyman work, etc. The prospects are endless; you need to buckle down and get on it!

Sell Until You Can’t Sell No More

Alright, this one hits close to home. Let’s be honest. We all have a pile, or piles, of unused, forgotten belongings that are cluttering up a corner, festering away, calling your name as you go to sleep at night…

Now more than ever is the time to rid yourself of that extra baggage and clear out that ridiculous stash you’ve unintentionally accumulated.

Host a garage sale, enlist your items on eBay or Craigslist, hit up the second-hand store with your preloved goods, sell your stuff to friends… Just offload your load. That’s it.

Ditch the Car and Embrace the Public Transport Life

Yaowch. Now’s the time to say hasta luego to your automobile.

Opt for walking, biking, bus riding, or boot scoot and tooting your way to work… Instead of burying your butt into that car seat, you’ll not only get fit while you’re at it but more importantly, be eliminating those incremental costs on car payments, insurance, parking fees, and gas/petrol. You could save anywhere between $50-300 per month…

More Ways to Save Money to Travel

Still not able to save up enough? Consider implementing the following tips into your day-to-day life…

Cut down on salon and spa costs. Those acrylic nails and lash extensions can wait

Open a dedicated Vacation Account

Automatically deduct money from your paycheck into your savings

Think of every night as movie night

Brown-bag it to lunch

Reduce your power, water, and gas bills. Turn off the lights and unplug the electronics

Buy books second-hand from the library

Re-evaluate your living space. What do you really need?

Sign up for freebies and rewards programs

Opt for take-out instead of dining-in

Set up a meal plan for the week

Barter (when feasible)

Sign up for rewards credit cards

Cut out/renegotiate cable/phone/internet

Clean out your credit bills

Rent out your spare room

FAQS

How can I save enough money to travel?

Decide on your travel destination, accommodation and activities and determine the budget. Cancel any unnecessary subscriptions, limit your online spending and set up a savings account.

What are seven ways to save money?

Make a weekly budget, set your priorities, track your spending, cut down on unnecessary purchases, look out for offers, stick to a grocery list and eliminate distractions.

How can I save money for a trip to Spain?

Opt for hostels or Airbnbs, eat like a local and fly with budget airlines like Vueling and Volotea.

So, there you have it. Which one of these pocket-saving tips have you tried? Do you have any creative ways to save money to travel?

Rome is known for its historical monuments, colourful culture and delectable cuisine. There’s plenty to pack into your itinerary, but if you tire of Italy’s capital, escape on one of these day trips from Rome.